Learn how we have managed our finances to reach financial independence and not stress about money. In this multi-part series you’ll learn the tactics, strategies, and conversations that led to our success in finances and love.

We have shifted our money management strategies many times during our relationship. Being flexible with our strategy has allowed us to adapt to changes in employment and life circumstances without becoming stressed out or making money the enemy. Below I’ve detailed how we have managed our finances from when we started living together before marriage to how we manage our money now as a married couple, partially retired living in Portugal.

Phase 1 – Multiple Accounts

When Mr. Scribbles and I started living together back in 2011, we were on different financial footings.

- Mr. Scribbles was…

- Debt free

- Had a decent 401k, and

- Earned a consistent pay check from his 9-to-5 job in IT

- I, on the other hand…

- Had a car loan on a 2007 Honda Civic LX (I know)

- A private student loan from one semester at an art school

- A federal student loan from the state school where I got my BA

- A revolving credit card balance, and

- I was a 1099 contractor so my income varied from month to month, from a few hundred dollars a month to $10k some months. Shortly after moving in together, I got a full-time W2 job so that helped with the consistency of my earnings

We decided to start our financial journey by opening three accounts at the same credit union (one joint checking account and two individual checking accounts) and one joint investment account at Fidelity Investments.

Splitting our recurring household bills 50/50 didn’t make sense to us because there was a significant delta in our earnings. So, we to split our bills based on our % of the total income. Each month we would deposit our portion of the joint bills into the joint checking account and not use that account for anything else.

All our bills were set to autopay from our joint checking account. Anything that was left in the joint checking account at the end of the month would either go into a savings account or into our joint Fidelity Investment account, which was invested in S&P 500 index funds.

We used direct deposit to make our lives easy. Within each of our employer’s payroll systems, we had them send X amount to the joint checking account and the balance to our individual checking accounts. After maxing out our 401k accounts, of course.

It wasn’t always easy and we navigated a lot of grey area as we learned about each other’s spending habits and what living together actually cost.

We would take turns buying dinners and groceries. After awhile I got tired of asking for grocery money because I did most of the shopping. So, once we had a few months of spending data, we added a grocery line item to the budget and I used the joint debit card for shopping. We would apply a similar logic of adding line items when new recurring expenses would arise.

Everything else came out of our personal checking accounts – happy hours, gym memberships, clothes, etc.

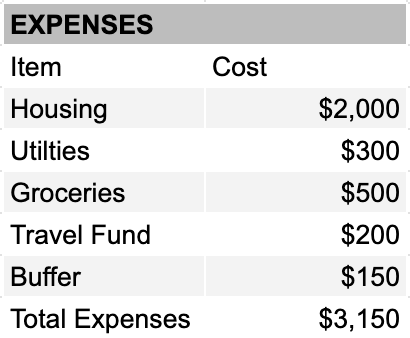

In the below example, the shared monthly expenses come to $3,150. This is the total that would need to be added to the joint checking account to cover all recurring monthly expenses.

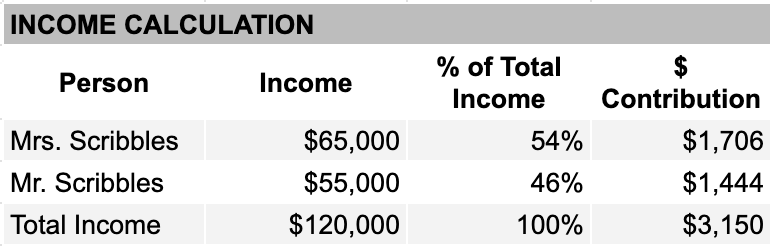

To figure out how much each person needs to contribute, add up each person’s income to get the total/combined income. Then divide each income by the combined income. The result is the percentage of the total income that each person pays towards the shared monthly expenses.

In this example, Mrs. Scribbles earns 54% ($65K) of the combined income ($120K), so pays $1,706 (54%) of the total expenses ($3,150). Mr. Scribbles earns 46% ($55K) of the combined income ($120K), so pays $1,444 (46%) of the total expenses.

Phase 2 – One Account

We existed happily in Phase 1 for a long time.

In 2018, I quit my full-time job and tried consulting for a bit. As a result, my income was variable. So we adapted our approach and deposited all funds into our joint checking account and did all our spending from that one account.

This took some getting use to because we always had our own private fun money from which we could do our own discretionary spending. Now we could see each other’s purchases. It made for some interesting conversations about how we were spending money. Mr. Scribbles was spending on something called “Steam” and I had a serious problem with Starbucks. C’est la vie!

I didn’t like earning significantly less than I was use to. And we definitely had a conversation about “allowances” and how we wouldn’t be using that term to refer to the money I got to spend on myself.

Eventually, I went back to a 9-to-5 job but we continued with the one account method, kinda.

Because we liked having our own discretionary money, we decided to deposit some of our pay checks into our personal checking accounts. The rest, after 401K contributions, went into our joint checking for all our family expenses from housing and groceries to clothing for the kids and membership fees. At the end of each month, we would transfer any extra money from the joint checking account to a savings account or invest in our mutual fund.

Phase 3 – Controlled Chaos

Now that we are living abroad our money feels scattered!

We still use the joint checking account at our credit union for all US finances. The only bills that we have to pay from our US bank account are our life insurances.

We still have two US credit cards with high available balances. We don’t have a Portuguese credit card and, at the moment, I don’t see a point in getting one. We can still use our US credit cards as usual in Europe and we do use it from time to time:

- When buying things from US online stores for family in the US

- When we have a large purchase, so that we can earn miles and not have to transfer large sums of money to our Portuguese bank account incurring currency conversion and transaction fees

To fund our early retirement, we sell stock in our Fidelity mutual funds then transfer the funds to our Portuguese bank using Wise.

Mr. Scribble’s pay checks from his full-time job here in Portugal, get deposited into our Portuguese bank account.

We pay our Portuguese bills and buy things in Portugal using our Portuguese debit card. We do have a savings account at our Portuguese bank and we transfer any extra funds at the end of each month there to create a cash buffer.